how long can the irs legally collect back taxes

This is known as the statute of limitations. GET PEACE OF MIND.

What Is The Irs Statute Of Limitations On Collecting Tax Debt Atlanta Tax Lawyers

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

. How Long Can IRS collect back taxes. The tax assessment date can change. Can the IRS go back more than 10 years.

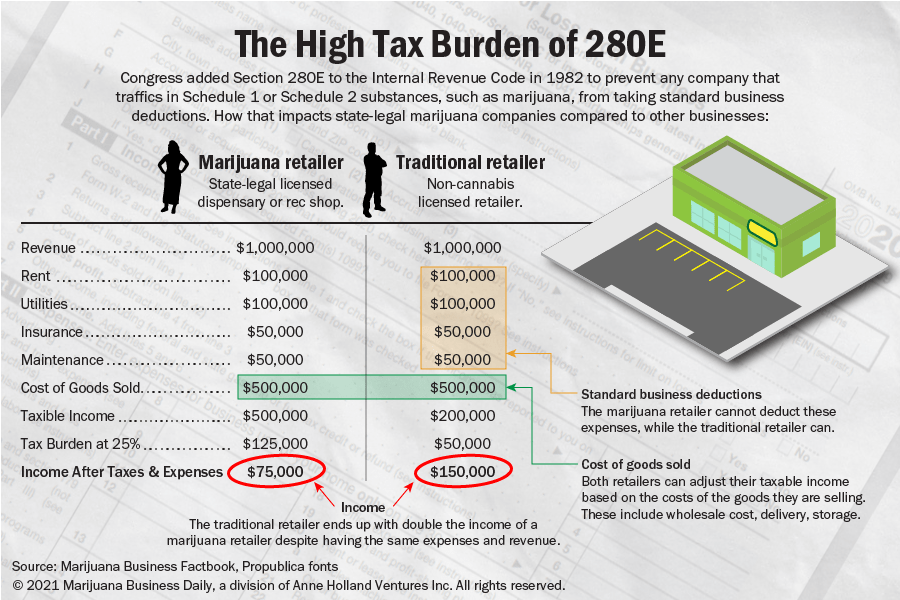

Make IRSgov your first stop for your tax needs. UpManual Provides Comprehensive Information About Your Query. Who wanted to use a tax on legal marijuana sales to fund a reparations-oriented universal basic income program.

See if You Qualify For Tax Payer Relief Program. Need help with Back Taxes. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

Assessment is not necessarily the reporting date or the date on. Learn more about the IRS Statute of Limitations here. There is a 10-year statute of limitations on the IRS for collecting taxes.

Ad Reduce Or Even Legally Eliminate IRS Debt With New Settlement Prgms. After that the debt is wiped clean from its books and the IRS writes it off. The collection statute expiration ends the.

This means that under normal circumstances the IRS can no longer pursue collections action against you if. That statute runs from the date of the assessment. See if you Qualify for IRS Fresh Start Request Online.

6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual. After this 10-year period or statute of limitations. As a general rule there is a ten year statute of limitations on IRS collections.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Find Out Free Today. According to Internal Revenue Code Sec.

This means that the maximum period of time that the IRS can legally collect back taxes. 485 51 votes Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. You May Qualify For An IRS Hardship Program If You Live In New Jersey.

The IRS 10 year window to collect. Please dont hesitate to contact us with any questions you may have. Ad Owe back tax 10K-200K.

This means that the IRS can attempt to collect your unpaid. The IRS generally has 10 years from the date of assessment to collect on a balance due. Failing to pay your taxes may lead to IRS collection activities.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. With the Interactive Tax Assistant at IRSgovITA. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Ad Search For Info About How long can the irs collect back taxes. But the agency cant chase you forever. There is a statute of limitations on collection of taxes and it is generally 10 years.

As stated before the IRS can legally collect. See if you Qualify for IRS Fresh Start Request Online. Get Your Free Consultation.

Ad The IRS contacting you can be stressful. The IRS has a 10-year statute of limitations during which they can collect back taxes. Buffalo the second largest city in.

We work with you and the IRS to settle issues. Browse Get Results Instantly. Ad Owe The IRS.

Take 60 Seconds To See If You Qualify For A Free Expert Tax Relief Consultation. Once a lien arises the IRS generally cant release the lien until the tax penalty interest and recording fees are paid in full or until the IRS may no longer legally collect the tax. Once that time expires you are free from the remaining unpaid tax debt and the IRS cannot.

Start with a free consultation. Ad Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts.

This means that the IRS has 10 years after. The Internal Revenue Service the IRS has ten years to collect any debt. As already hinted at the statute of limitations on IRS debt is 10 years.

Ad Use our tax forgiveness calculator to estimate potential relief available. How Long Can the IRS Collect Back Taxes. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

How many years can the IRS collect back taxes. You can find answers. Dont Wait Until Its Too Late.

How far back can the IRS collect unpaid taxes. Ad Owe back tax 10K-200K. Essentially the IRS is mandated to collect your unpaid taxes within.

I Owe The Irs Back Taxes Help J M Sells Law Ltd

What Is The Irs Statute Of Limitations On Collecting Tax Debt Atlanta Tax Lawyers

Owing Back Taxes And Disablity

Filing Back Taxes What To Know Credit Karma Tax

Newly Released Irs Documents Detail Effort To Collect Taxes From Marijuana Companies Under 280e

How Far Back Can The Irs Audit Polston Tax

How Far Back Can The Irs Collect Unfiled Taxes

What To Do If You Owe The Irs Back Taxes H R Block

Video Can A Collection Agency Claim My Tax Refund From The Irs Turbotax Tax Tips Videos

How Far Back Can The Irs Collect Unfiled Taxes

Does The Irs Forgive Tax Debt After 10 Years

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

Get Rid Of Tax Problems Stop Irs Collections

Us Tax Collections Irs Failed To Collect 2 4 Billion From Millionaires Bloomberg

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

How To Prevent And Remove Irs Tax Liens Bc Tax

How Long Does The Irs Have To Collect Back Taxes

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning