tax shield formula cpa

The tax shield Johnson Industries Inc. So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing arrangement.

What Is A Depreciation Tax Shield Universal Cpa Review

C net initial investment T corporate tax rate k discount rate or time value of money d maximum rate of capital cost allowance 2.

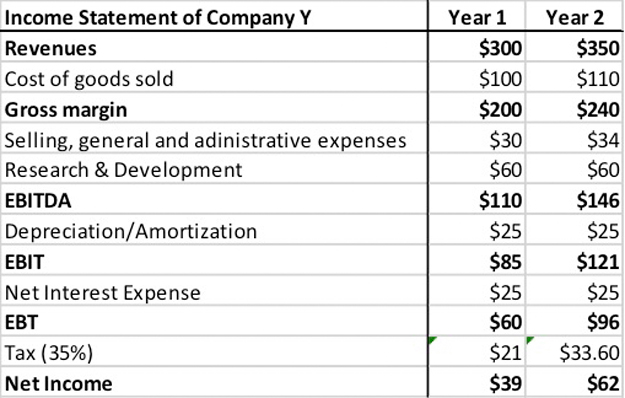

. CPA COMMON FINAL EXAMINATION REFERENCE SCHEDULE 1. Developing CCA Tax Shield Formula 1000000 asset 5 declining balance CCA rate 35 tax. Will receive as a result of a reduction in its income would equal 25000 multiplied by 37 or 9250.

The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40. Interest rates for taxable benefits. The primary objective of a tax shield is to lower the tax liability or shield income from.

For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the tax shield approach will be worth 200. This is equivalent to the 800000 interest expense multiplied by 35. One of the.

CPA CFE REFERENCE SCHEDULE 2018 1. Let us look at a detailed example when a company prepares its tax income 1 accounting for depreciation expense and 2 not taking depreciation expense. The Tax Shield approach minimizes the tax bills for the taxpayer.

Tax Shield Value of Tax Deductible - Expense x Tax Rate Example If a business has 1000 in mortgage interest and its tax rate. As a result of the Sec. It also has an option to write off only a minimum amount of 2700.

Or we can say it is the reduction in the assessable income because of the use of allowable deductions. 338h10 election Buyer is viewed as owning New Target and New Target has a cost basis in the assets it is deemed to have. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

The maximum depreciation expense it can write off this year is 25000. How to Calculate Tax Shield. TABLE III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE.

Kautter CPA Ernst Young LLP. Thus a tax shield is an amount by which the depreciation and amortization or any non-cash charge lower your income subject to taxation creating cash savings. Case 1 Taxable Income with Depreciation Expense.

The formula for calculating a depreciation tax shield is easy. SELECTED PRESCRIBED AUTOMOBILE AMOUNTS. Based on the information do the calculation of the tax shield enjoyed by the company.

A depreciation tax shield is the savings of the tax due to depreciation expense in the company and it is calculated as depreciation debited to profit and loss account multiplied by the applicable tax rate where the depreciation tax shield is directly related to the depreciation debited ie higher the depreciation debited to the profit and loss. Tax Shield formula. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give you 3500.

Calculation of the tax shield follows a simplified formula as shown below. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of Total Tax Shield from CCA for a New Asset Notation for above formula. CPA Canada s Reference Schedule of allowances and tax rates used in their Core evaluations Keywords.

The result equals the depreciation tax. Target is fully taxed on the fictional sale of its assets to New Target and no further tax liability results because Target is deemed to have liquidated tax free into Parent under Sec. The value of a tax shield is calculated as the amount of the taxable expense multiplied by the tax rate.

This reduces the tax it needs to pay by 280000. C net initial investment T corporate tax rate. Definition of Depreciation Tax Shield.

For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. All you need to do is multiply depreciation expense for tax purposes not financial purposes and multiply by the effective income tax rate. Tax Shield Amount of tax-deductible expense x Tax rate.

The Service has issued an industry director directive IDD LMSB-04-0807-056 on contractual allowance issues in the health care industry. The IDD provides direction to the field on the efficient use of examination resources relating to the audit of contractual allowances. A Tax Shield is the use of taxable expense that helps a business to lower its tax liability.

View Notes - CCA Tax Shield Notes from FINE 2000 at York University. Present value PV tax shield formula. Tax Shield Meaning Importance Calculation and More.

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Investment Cost Marginal Rate of Income tax Rate of Capital Cost Allowance xl ry Rate of Return Alffilfftq x 1 Rate of Return MAXIMIJM CAPITAL COST ALLOWANCE RATES FOR SELECTED CLASSES. Calculating the tax shield can be simplified by using this formula.

Interest Tax Shield Interest Expense Tax Rate. Federal income tax rates. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900.

The tax rate for the company is 30. Capital cost allowance rates. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

As such the shield is 8000000 x 10 x 35 280000. Depreciation tax shield 30 x 50000 15000. Do the calculation of Tax Shield enjoyed by the company.

The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for above formula. The applicable tax rate is 37.

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

Tax Shield Formula Step By Step Calculation With Examples

Cca 1 Pptx Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes Cca Is Deducted Before Taxes And Acts As A Tax Shield Every Capital Course Hero

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

Tax Shield Formula Step By Step Calculation With Examples

How Is Agi Calculated In Tax Universal Cpa Review

Basic Income Tax Formula Minimizing Tax Audits Gross Chegg Com

What Is Net Operating Profit After Taxes Nopat Definition Meaning Example

Disposable Income Formula Examples With Excel Template

Capital Cost Allowance Canada Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Definition Formula Example Calculation Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Formula Tax Deductions Tax Above The Line

Current Yield Meaning Importance Formula And More Finance Investing Learn Accounting Accounting Basics

Ebit Calculation Examples Of Ebit Earnings Before Interest And Taxes

Taxable Income Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)