how to claim new mexico solar tax credit

Enter Your Zip See If You Qualify. B Year of approval.

Engineer Mechanical Engineer And Futurist Nikola Tesla Initially It Was Concealed From The Genera In 2021 Senior Discounts Money Making Hacks Life Insurance Policy

The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable credits.

. Claiming the New Mexico Solar Tax Credit Step One. Enter the tax year in which the electricity was produced for this claim. Check Rebates Incentives.

Federal Solar Tax Credit Filing Step-by-Step Fill in Form 1040 as you normally would. When you receive approval from EMNRD follow these steps to claim the credit. Enter the date the qualified energy generator began producing electricity.

Check 2022 Top Rated Solar Incentives in New Mexico. This is the PDF document originally. This incentive is proposed to last until January 2029.

New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers. The first is your application packet filled out electronically. Any solar installations in your home or business will allow you to claim new mexico solar tax credits of as much as 10.

Calculate credit claimed for the current tax year. See below for forms. It covers 10 of your installation costs up to a maximum of 6000.

Taxpayers who own businesses or agricultural enterprises can also claim a New Mexico state income tax credit for a solar system they install in their business. This requires the review and verification of energy production information for the New Mexico Taxation and Revenue Department. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit.

The balance of any refundable credits after paying all taxes due is refunded to you. New Mexico state solar tax credit. Upload the first of two PDF documents.

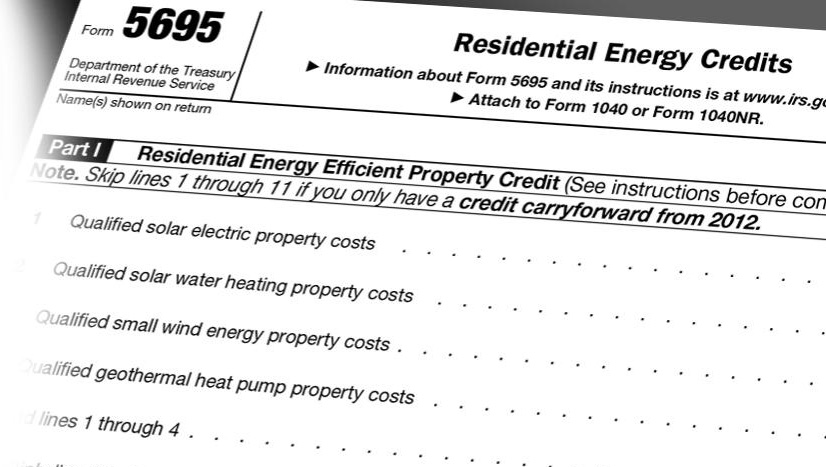

When you get to line 53 its time to switch to Form 5695. Get in touch with your nearest New Mexico solar company to get a personalized estimate of how much you can cut down on your expenses by installing solar panels on your roof. Find out how much your solar credit is worth.

An applicant shall apply for the state tax credit with the taxation and revenue department and provide the certification and any other information the tax and revenue department requires within 12 months following the calendar year in which the system was installed. Tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2006 and has purchased and installed a qualified photovoltaic or a solar thermal system after January 1 2006 but before December 31 2016 in a residence business or agricultural enterprise in New Mexico owned by that taxpayer. See form PIT-RC Rebate and Credit Schedule.

New Solar Market Development Income Tax Credit Electronic Submission. For assistance completing this form or claiming the credit call 505 827-0792. Complete Form RPD-41227 Renewable Energy Production Tax Credit Claim Form.

To put this in perspective a 10 rebate on your state tax of 18000 USD can bring down the total cost of your system to 16200 USD. The federal solar tax credit. Since most average sized 6kW systems cost about 18000 you can expect a credit of about 1800.

If two separate systems are installed photovoltaic and solar water heating state tax credits can be claimed for both for a total credit of up to 18000. Ad Enter Your Zip Code - Get Qualified Instantly. Enter the project number shown on the certificate of eligibility for the new solar market development tax credit issued to you by EMNRD.

C Amount of credit approved. Enter the tax year for which the new solar market development tax credit has been certified as indi-cated on the certificate of eligibility. For example if your solar PV system was installed before December 31 2022 installation costs totaled 18000 and your state government gave you a one-time rebate of 1000 for installing the system your federal tax credit would be calculated as.

Fill Out the Application The New Mexico Energy Minerals and Natural Resources Department EMNRD oversees. Fill Out the Binder of Required PDFs. NM State RE Tax Credits New Mexico provides a 10 personal income tax credit up to 9000 for individuals sole proprietorship businesses and agricultural enterprises who purchase and install certified photovoltaic PV and solar thermal systems.

Or if the taxpayer files a fiscal-year or a short-year return enter the beginning and ending dates of the tax year. Determine if youre eligible Complete IRS Form 5695 Add to Schedule 3 and Form 1040 For the purposes of this article lets assume the gross cost of your solar system is 25000. CLAIMING THE STATE TAX CREDIT.

The 3 steps to claiming the solar tax credit There are three main steps youll need to take in order to benefit from the ITC. Form RPD-41317 PDF Form Content Report Error It appears you dont have a PDF plugin for this browser. Enter the full amount you paid to have your solar system installed in line 1.

The tax credit applies to residential commercial and agricultural installations. New Mexico Form RPD-41317 New Mexico Solar Market Development Income Tax Credit Claim F There are only 40 days left until tax day on April 15th. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit.

The good news is that the law is retroactive so long as you managed to install your system after Jan. ECMD reviews and approves the production allocation of tax credits among investors in utility-scale wind and solar PV systems installed under this Act until 2026 when the program expires. In the Credit Approval Number box enter the last day of the tax year when the electricity was produced for which you are claiming a credit or a carryforward.

However the amount of your claim should not exceed 6000. EFile your return online here or request a six-month extension here. This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower.

Solar Tax Credit Details H R Block

Seniors Need To Claim These Benefits Debt Relief Programs Best Money Saving Tips Senior Discounts

New Mexico Solar Incentives Rebates And Tax Credits

Renewable Energy Costs Take Another Tumble Making Fossil Fuels Look More Expensive Than Ever

Tax Credit Info Daylighting Systems Solar Powered Fans Solatube

Federal Solar Tax Credit 2022 How It Works How Much It Saves

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

Stamp Duty Stamp Duty Good Credit Save Yourself

Chinese Solar Panel Shipments Threatened By Tariffs The Washington Post

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Georgia Georgia Albany Georgia Georgia History

Uk Hmrc Plans Vat Increase On Solar And Battery Storage

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

How Do Solar Panels Work Alte Store Blog

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions